2025 Max Contribution. Roth ira 2025 contribution limit. For individuals 50 and above, there.

The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

2025 402g Limit Kary Sarena, The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. Complete guide to your cpf contributions in singapore (2025):

2025 Traditional Ira Limits Elaina Stafani, The irs increased 2025 contribution limits for 401 (k)s, 403 (b)s, and iras. 2025 traditional and roth ira contribution limits.

Significant HSA Contribution Limit Increase for 2025, Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5. Older workers can defer paying income tax on as much as $30,500 in a.

2025 Irs Contribution Limits 401k Cammy Caressa, The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. Traditional ira contribution limits for 2025.

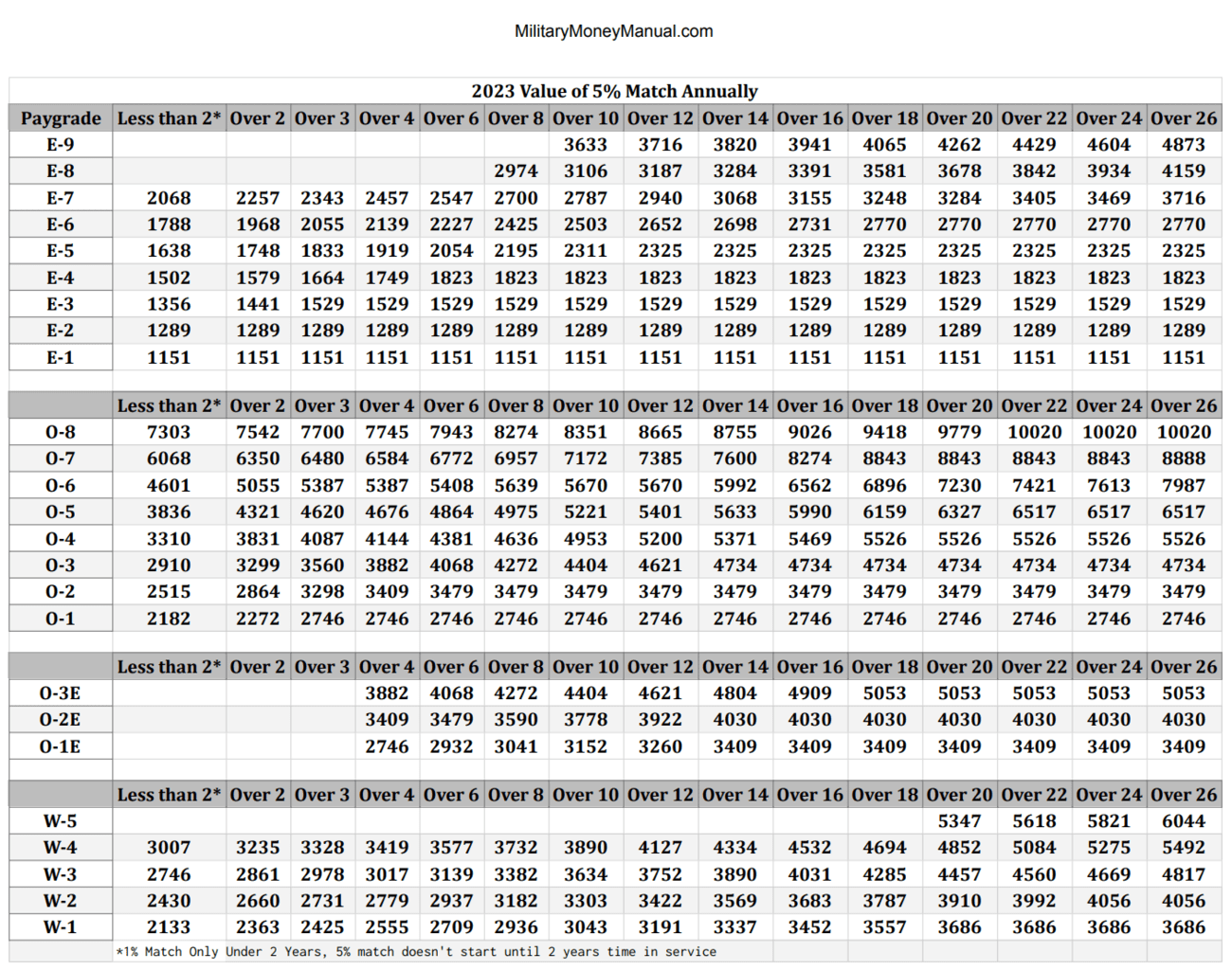

TSP Max Contribution 2025 Military BRS Match Per Pay Period, 2025 retirement account contribution amounts. Complete guide to your cpf contributions in singapore (2025):

Gdc 2025 Guideline Value Dacie Kikelia, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5.

SSS Contribution Table 2025 SSS Answers, Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

Roth Contribution Limits 2025 Caril Cortney, The irs increased 2025 contribution limits for 401 (k)s, 403 (b)s, and iras. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

TSP Max Contribution 2025 Military BRS Match Per Pay Period, The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

2025 Defined Contribution Limits Cammy Caressa, Traditional ira contribution limits for 2025. In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited.